A spokesperson for Gov. Haslam has admitted that up to $70 million of highway user fees collected by the State of Tennessee, primarily from gas taxes, can be spent on mass transit in the FY 2017-2018 budget.

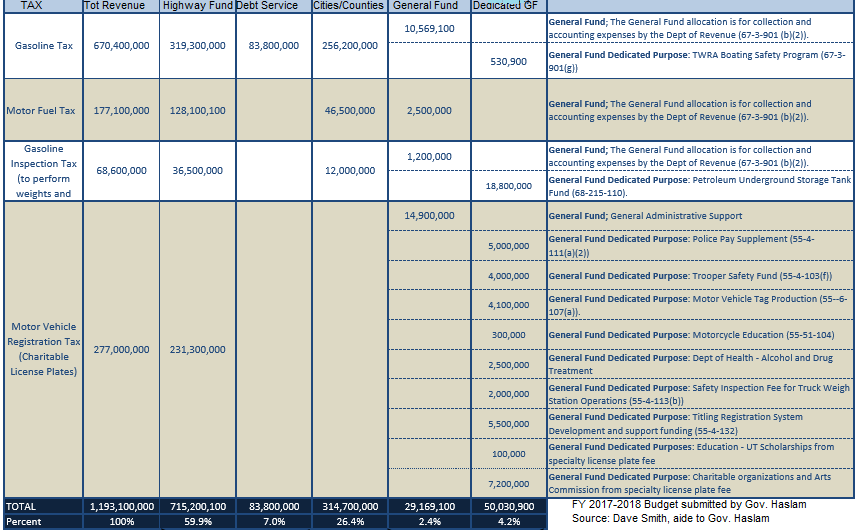

In that budget, which he transmitted to the Tennessee General Assembly on January 30 of this year, Gov. Haslam estimates that $314.7 million of the $1.2 billion in highway user fees the State of Tennessee will collect in the upcoming fiscal year will be given to cities and counties.

Those “Funds may be expended by municipalities receiving the funds for the purpose of funding mass transit systems,” Gov. Haslam’s top aide, Dave Smith, says in an email statement provided to The Tennessee Star by 99.7 FM WWTN’s Ralph Bristol, host of Nashville’s Morning News.

“No more than 22.22% of the funds may be used for the purpose of funding mass transit,” Smith continues, citing Tennessee Code Annotated § 54-4-203-204.

“No more than 22.22% of county funds may be expended for the purpose of funding mass transit,” Smith adds, citing Tennessee Code Annotated § 54-4-103.

The total amount cities and counties may expend “for the purpose of funding mass transit” in FY 2017-FY 2018 under the budget Gov. Haslam first proposed for that fiscal year, is $69.7 million (which rounds up to $70 million), or 22.22 percent of $314.7 million.

Smith provided a detailed chart describing the expenditures of the $1.2 billion in highway user fees expected to be collected by the State of Tennessee in FY 2017-18, as documented on page A-67 of the governor’s budget document, which can be seen in the headline image of this article.

There is one significant omission in Smith’s chart.

It does not include the $278.5 million in additional revenue, primarily from a 7 cents a gallon gas tax increase and a 12 cents a gallon diesel tax increase, that will be collected by the State of Tennessee in FY 2017-18 if Gov. Haslam’s IMPROVE Act is passed into law by the Tennessee General Assembly and signed by the governor.

Gov. Haslam announced his IMPROVE Act proposal on January 18 of this year, twelve days before he submitted his FY 2017-18 budget to the Tennessee General Assembly.

Some of this additional $278.5 million in gas tax revenues collected by all Tennesseans–as much as an additional $16 million–can be used by cities and counties for mass transit, which will bring the total amount diverted to mass transit for FY 2017-18 to $85.7 million.

Even omitting the extra funds that will be diverted from road construction due to the proposed IMPROVE Act gas tax increases, the total amount of highway user funds expected to be collected by the State of Tennessee during FY 2017-2018 that can be diverted from the purpose of road construction totals $256.7 million: $187 million that The Star reported previously is diverted to the General Fund, Debt Service, and Education, and the up-to $69.7 million cities and counties can spend on mass transit.

“A lot of rural legislators have pointed out that this gas tax in is particulary punitive to their communities,” former Nashville talk radio host Steve Gill tells The Star.

“Now we find out that a lot of that money taken from our rural neighbors will be spent on mass transit in inner cities and rich suburbs,” Gill adds.

This new information means that only 79 percent of the $1.2 billion in highway user fees is certain to be spent on road construction.

A very significant 21 percent of highway user fees can be spent on “non-road construction” activities.

[…] Haslam explicitly admitting that that up to $70 million of the gas tax can be spent on mass transit by cities and counties, the […]

How can any public official support this after the true numbers are exposed by ATM Star ? I guess that public transportation is required in our cities so that the elites don’t have to have someone pick up and return the maids and housekeepers each and every day ! WHAT you country bumpkins don’t have maids . So sorry for you.